Credit Card Font

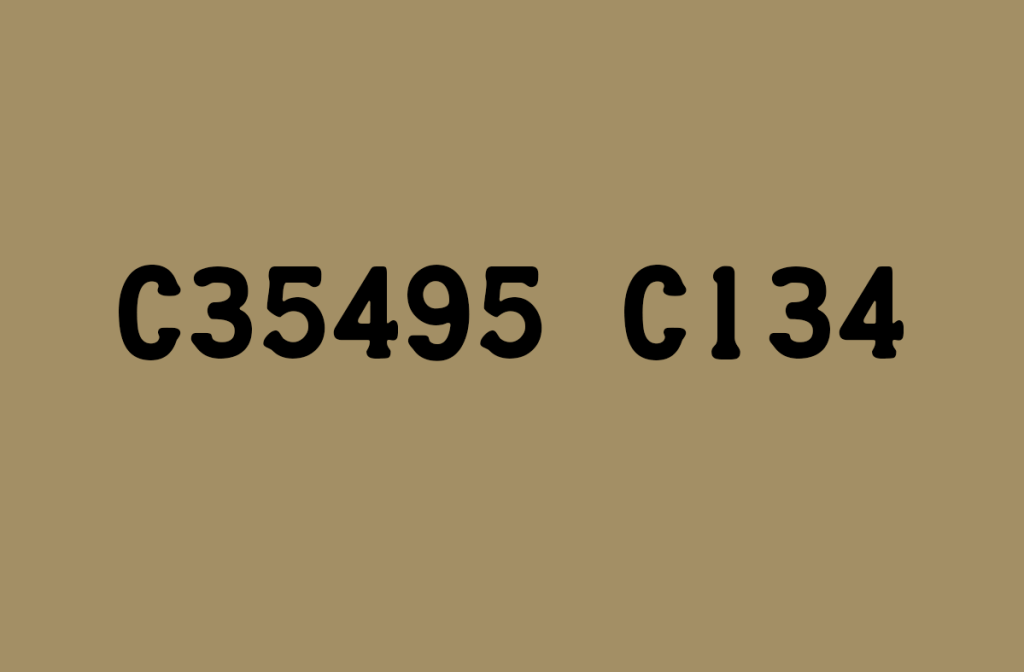

Credit Card Font refers to the specialized typeface used on credit cards for readability, security, and compliance purposes. This font, often a variation of the OCR (Optical Character Recognition) font, is designed to be easily readable by humans and electronic systems.

Its clarity and distinct style help minimize errors during the electronic scanning and processing of credit card information, enhancing the efficiency of transactions.

You can find more free Serif fonts here.

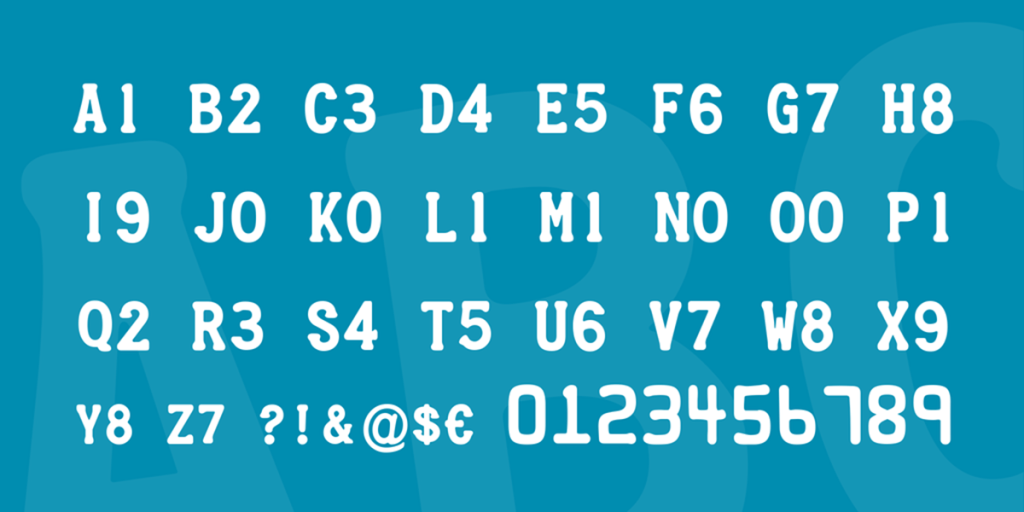

Uppercase, Lowercase & Symbols Font

History of Credit Card Font

The typography used on credit cards, the Credit Card font, is designed for maximum readability and security. It originated in the 1950s, a period that saw the birth of the credit card industry. The font needed to be machine-readable, which led to adopting the OCR (Optical Character Recognition) technology. This technology was crucial for automating the reading of card information during transactions.

The OCR-A, and later, the more refined OCR-B font, became standards for credit card and financial document legibility. These fonts were explicitly designed to be easily read by both humans and machines, a factor that significantly reduced processing errors and fraud. Over the years, advancements in technology and changes in card manufacturing processes have allowed for more design flexibility while maintaining the integrity of the OCR requirements.

Characteristics of Credit Card Font

Here are some of the Characteristics of Credit Card Font:

- Machine-Readable: The primary characteristic of this font is its compatibility with OCR technology, making it easily readable by automated systems.

- High Contrast: This font is designed for high contrast against their background, improving legibility under various lighting conditions.

- Monospaced: Each character occupies the same amount of horizontal space, ensuring uniformity and facilitating easier reading by OCR systems.

- Distinctive Character Shapes: The shapes of characters in credit card fonts are distinct to prevent confusion between similar-looking letters and numbers, reducing errors in reading.

- Simple Design: The font design is straightforward, avoiding complex details that could interfere with machine readability.

- Durability: The font is designed to be durable, maintaining legibility even with wear and tear over time.

Impact of Credit Card Font

The impact of the Credit Card font on the financial industry, security measures, and user experience cannot be overstated. Below are detailed aspects of its impact:

1. Enhancing Security

Adopting OCR-compatible fonts, like OCR-A and OCR-B, has significantly bolstered security in financial transactions. Ensuring that humans and machines can accurately read card information dramatically reduces the potential for errors and fraudulent activities. The unique and distinct character shapes help minimize the risk of misinterpretation and unauthorized use.

2. Streamlining Processing

Credit Card fonts have streamlined the processing of transactions by enabling quicker verification and automation. This efficiency has reduced the time it takes for transactions and lowered the costs associated with manual data entry and error correction.

3. Facilitating International Use

The straightforward design of Credit Card font has facilitated its use across different countries and languages, promoting a standardized system for global financial transactions. This universality has been instrumental in expanding international commerce and online shopping.

4. Improving Customer Experience

This font contributes to a smoother, more reliable customer experience by ensuring high readability and reducing transaction errors. Users can trust in the efficiency and security of their card transactions, which fosters greater confidence in electronic payment systems overall.

5. Advancing Technology Adoption

Finally, Credit Card font has been a critical factor in adopting newer technologies in the financial sector, including mobile payments and contactless transactions. Its compatibility with various devices and systems has allowed for innovation in how payments are processed and accepted, paving the way for a more digital and accessible future in finance.